Table of Contents

House Cleaning Business Forms for Taxes, Business Entities, and Operations

House cleaning business forms can refer to many different kinds of forms. We’ve cataloged a few to help you in your search.

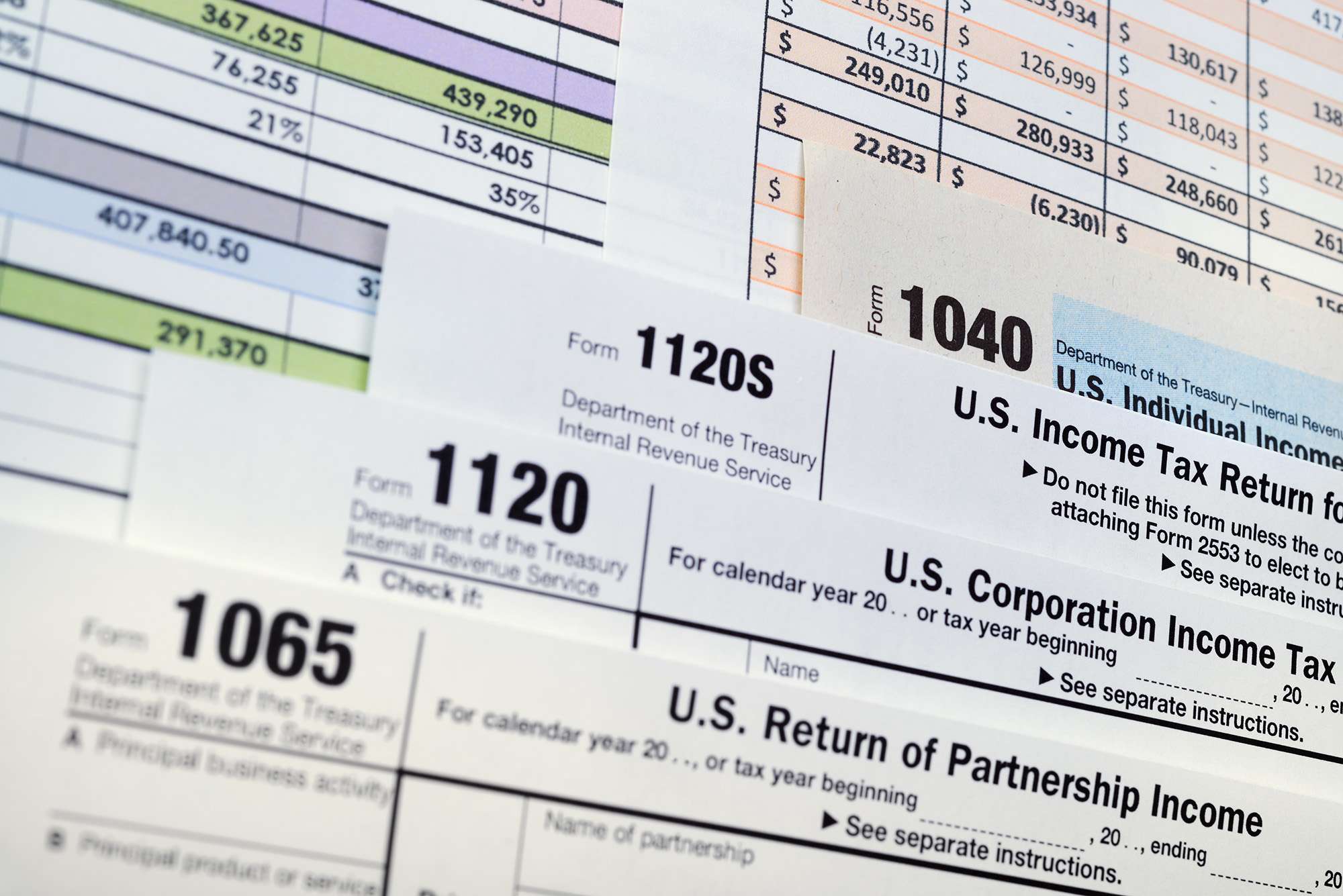

Tax forms for cleaning businesses

There are many types of tax forms for cleaning businesses. We’ll address a few of the common ones.

General warning: Taxes are complex, and we’re not tax attorneys, so please use our advice as a starting point for more research on your taxes.

Sole Proprietor

Sole proprietorships often use form 1040 to file federal taxes. The IRS has a helpful page set up specifically catered to sole proprietorships, to help small businesses determine the type of form needed for differing business entities.

Here’s how the IRS defines a sole proprietorship

A sole proprietor is someone who owns an unincorporated business by himself or herself. However, if you are the sole member of a domestic limited liability company (LLC), you are not a sole proprietor if you elect to treat the LLC as a corporation.

You also might need a Schedule C form, profit or loss from a business. You can read more on the IRS website to determine if this is something you need for your business.

Limited Liability Company

A limited liability company (LLC) is another common way that cleaning businesses are structured. If you’re looking for LLC tax forms, you’ll need to check out the IRS page on LLCs.

Here’s what the IRS says about filing taxes as an LLC

Depending on elections made by the LLC and the number of members, the IRS will treat an LLC as either a corporation, partnership, or as part of the LLC’s owner’s tax return (a “disregarded entity”). Specifically, a domestic LLC with at least two members is classified as a partnership for federal income tax purposes unless it files Form 8832 and affirmatively elects to be treated as a corporation. For income tax purposes, an LLC with only one member is treated as an entity disregarded as separate from its owner, unless it files Form 8832 and elects to be treated as a corporation. However, for purposes of employment tax and certain excise taxes, an LLC with only one member is still considered a separate entity.

LLCs are chartered by state governments, so it’s important to look up the rules for your individual state to make sure you don’t miss any tax rules your home state imposes on LLCs.

Forms for creating business entities

Sole Proprietorship

There’s no paperwork necessary to create a sole proprietorship business structure – but that doesn’t mean that you won’t have state-level tax forms and licenses to complete or that your local municipality doesn’t have a license to operate a business in the city limits.

Since these rules are different state by state and city by city, you’ll need to check out your state and city regulations for owning a business.

LLC

LLC’s are chartered by states, so you’ll need to look up the secretary of state website in your home state to see about applicable laws and statutes.

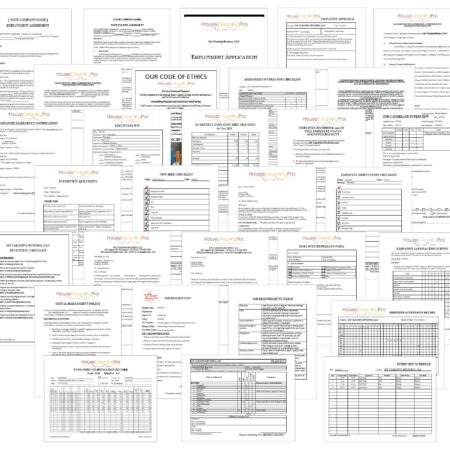

Operational cleaning business forms

The house cleaning business form has a specific purpose in your house cleaning business. The house cleaning business form is designed to streamline your operations. Some of these forms also help you grow your business with the tracking of specific information.

That’s why the House Cleaning Pro designed her own forms when the information needed to run a residential cleaning business was missing from cleaning business form templates.

All of the house cleaning forms we provide are printable and fillable, as formatted templates with suggested text. You can customize each cleaning business form as needed for your house cleaning business.

Customer-facing forms

Customer-facing business forms also have a specific purpose in your business. These forms help you maintain a professional appearance as you’re communicating with your customers.

-

Cleaning Estimate Worksheet – Fast and Accurate

$19 Add to cart -

Cleaning Service Agreement for House Cleaning Businesses

$12 Add to cart -

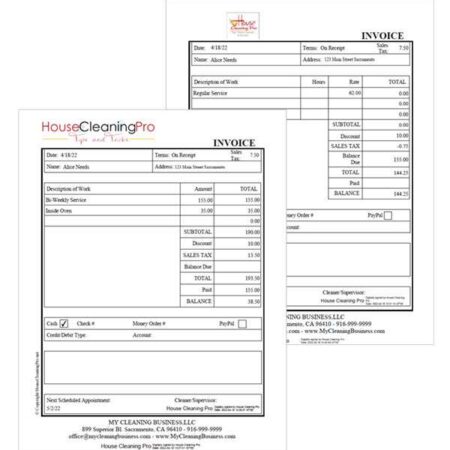

Client invoice form for house cleaning businesses

$9 Add to cart -

Client Welcome Packet Bundle

$12 Add to cart -

Employee and HR forms bundle

$37 Add to cart -

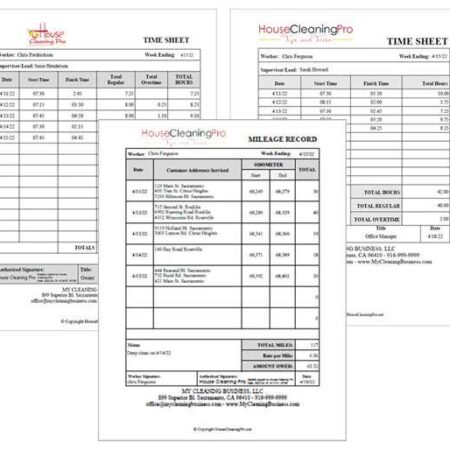

Employee Time Sheet and Mileage Record

$9 Add to cart -

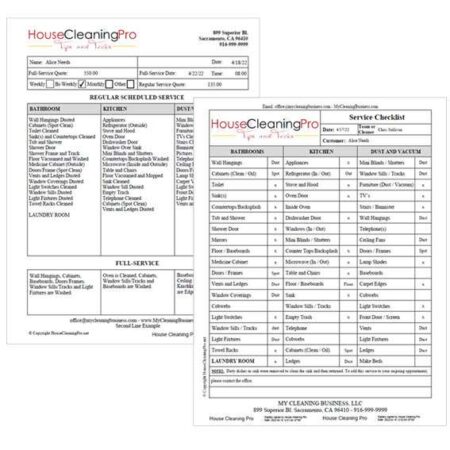

House Cleaning Business Checklist

$9 Add to cart -

House Cleaning Business Forms Package

$99 Add to cart -

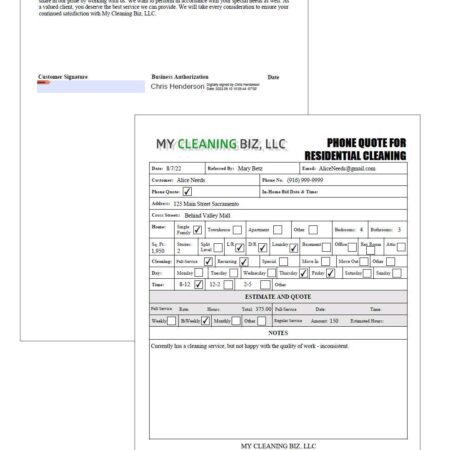

Phone Quote Form

$4 Add to cart -

Work Order Template

$7 Add to cart